Closing fiscal year in Microsoft Dynamics 365 Business Central

Closing year end within Dynamics 365 Business Central doesn't have to be a scary thing. There are a few steps to complete this task.

- I highly recommend creating a test company first so you can close and verify everything looks fine before doing the next steps within your production company. If you're not familiar with creating a test company check out this blog and have your system administrator create a test company for you.

- Once you have a test company setup go ahead and log into that company.

- Verify via the chart of accounts that all accounts are set up with the correct Income/Balance type. You wouldn't want an account to be incorrect and then have to fix after closing out the income statement...what a pain that would be.

- Next step is to close the accounting periods. Search for Accounting Periods and then select Process > Close Year. Once you select close year you will receive a pop up that says: This function closes the fiscal year from 01/01/20 to 12/31/20. Once the fiscal year is closed it cannot be opened again, and the periods in the fiscal year cannot be changed. Do you want to close the fiscal year? Once you select yes the check boxes for the periods within the year closing will be checked.

- The next step is the close the income statement. To do this search for Close Income Statement and verify the options within the window. A few things to remember is that the Document No. can be blank and that if you're using dimensions you want to make sure to click on the ellipsis to the right of the Dimensions field and make sure ALL of them are selected. This may be the #1 thing users forget to verify when closing the income statement and trust me when I say it isn't a quick and easy fix either.

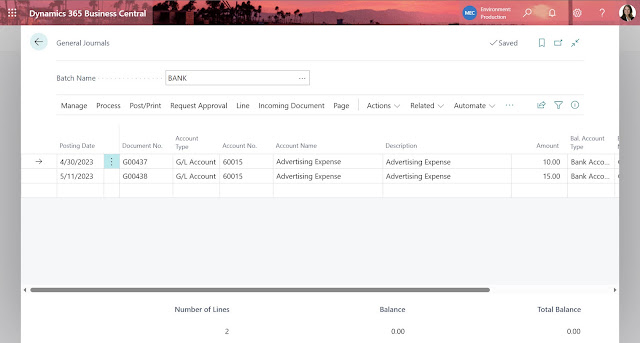

- Once you've closed out the income statement navigate to the General Journal and review the batch which has your P&L accounts closing to the retained earnings account. Once verified you can post that batch.

- Review your financial reports the income statement and balance sheet.

- Once happy with results follow the steps within your production company.

How to enter adjustments after you've closed year end

If you have year end adjustments that need to be entered that's ok. Go ahead and enter and post them through the general journal and then close the income statement and review and post the closing entry.

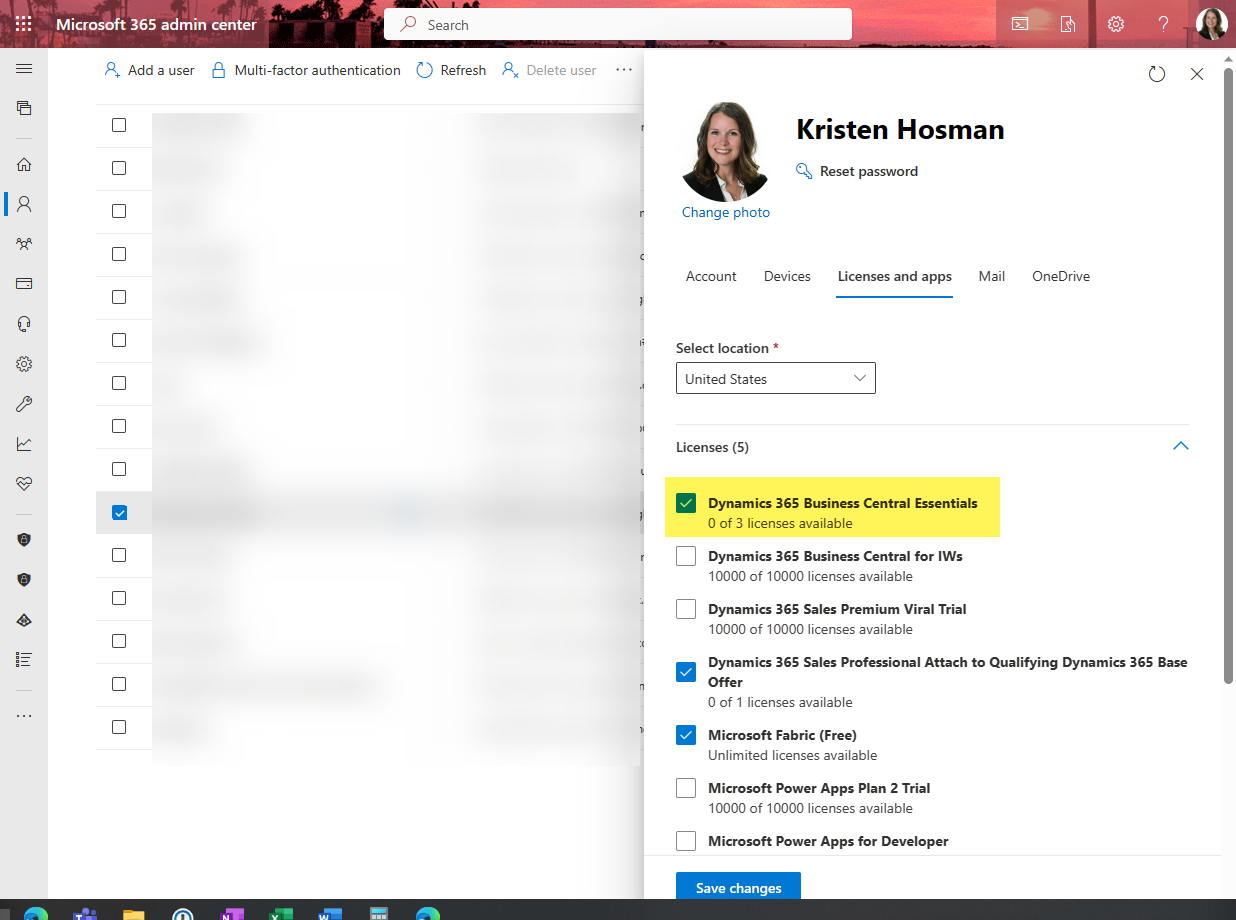

Written by: Kristen Hosman, Microsoft MVP

Comments