Processing 1099's in Business Central v19.2 for 2021

Processing 1099's in Business Central v19.2

If you're not on v19.2 yet, then you may run into issues printing 2021 1099's. See my previous blog on this information.

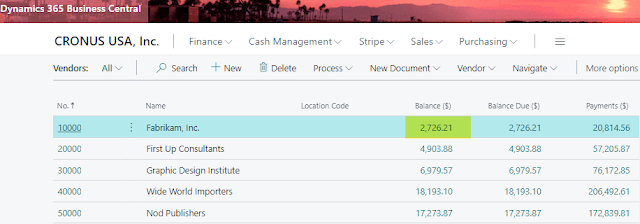

Processing 1099's is pretty easy in Microsoft 365 Business Central. Here are a few pointers:

- Verify the vendor Name and Address on the vendor card. This is what's going to print on the 1099.

- Verify vendor IRS 1099 Code and Federal ID No. on the vendor card.

- Once you've tested and everything lines up then you can remove the test print toggle and print.

Remember there are other tools to review vendor 1099 information before committing to printing them. Within the vendor card go into Reports > Vendor 1099 Misc/Vendor 1099 Information to review as well.

Comments