Over-Receipt Code for Purchase Orders

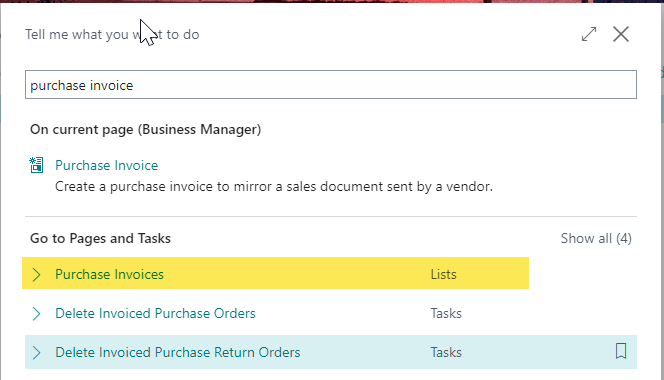

Client: We are unable to process invoices that go over the PO amount. Is there a way to have the system accept up to 5% over the amount of the purchase order? We are currently reopening and changing the purchase orders at each instance. 1. Create Over Receipt Code: Use the Tell Me search feature by pressing ALT+Q, then type "Over receipt" and select "Over-Receipt Codes" from the list. This will bring up the page where you can manage over receipt settings. 2. Create Over Receipt Code: On the Over-Receipt Codes page, you can create new codes that define the percentage tolerance for over-receiving. For example, create one code for a 5%. The code will specify how much more than the ordered quantity can be received. Optional Approval Workflow: If you want to require approval for over-receiving, you can check the "Approval required" checkbox on the Over Receipt Codes page. This will enforce a workflow where excessive receipts must be approved before they can be...