Processing 2021 1099's in Dynamics 365 Business Central update

Every January accountants and CPA's start thinking about 1099's and the deadline is February 1, 2022, per the IRS website.

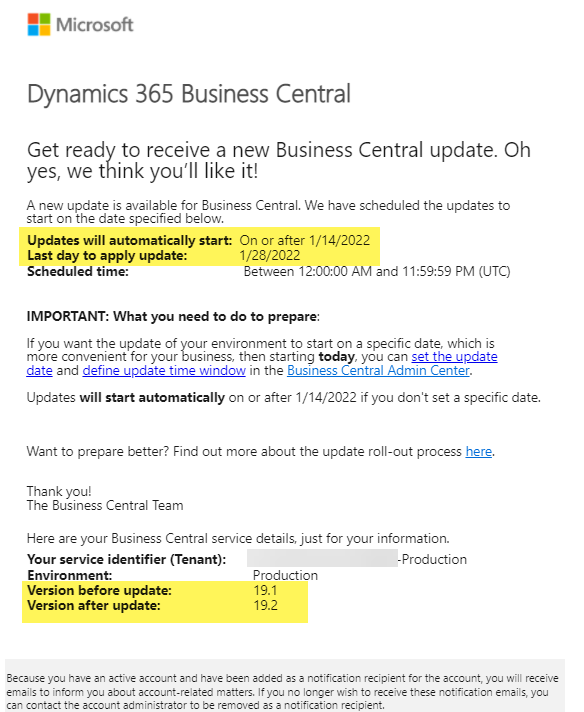

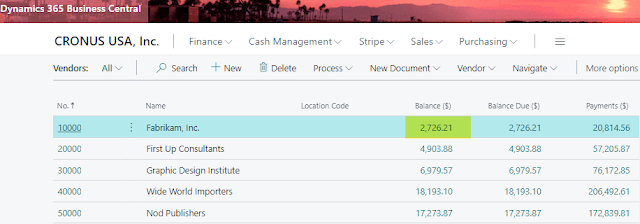

If you're on Microsoft Dynamics 365 Business Central version 19.1 then you'll have to wait until your environment is updated to version 19.2 to have the tax form updates within the system. If you're not sure what version you're on, then you can check via the Dynamics 365 Business Central admin center or within Business Central's help and support as well.

Those set up as the Notification Recipients should've received an email like below letting them know the update is coming. This email also lets them know if Microsoft has detected any issues, like an extension that isn't compatible with the new version. If there are issue detected, then they must be resolved prior to the update happening otherwise it won't happen.

Comments