Setting up Sales and Use Tax in Microsoft Dynamics 365 Business Central

What is a tax jurisdiction and tax area?

There are two major steps to setting up sales and use tax in Business Central. The first is tax jurisdictions and the second is tax areas. A tax jurisdiction is a city, county, state, or other special tax that requires taxes within its limits. A tax area is a physical area, and each area can be assessed taxes by different jurisdictions.

Tax Jurisdictions

You're going to want to setup a new jurisdiction per city, county, state, or other special tax. I'm going to use zip code 80470 for an example. I pulled the following information from online and it shows that for zip code 80470 there are four jurisdictions totaling 4.5% sales tax.

- Search for tax jurisdictions

- Click on +New

- Complete the information in the new row. In this case I left Default Sales and Use Tax percentage as 0 since I have several tax groups codes setup.

- Select the line and then click on Details.

- Within the Tax Details window add the unique Tax Group Codes that pertain to sales and use tax within that jurisdiction. Add the sales tax percentage to the Tax Below Maximum field.

- In my zip code 80470 example I have three more jurisdictions to setup yet. So, I'll go ahead and do those now before moving onto tax areas.

Tax Areas

A tax area is a physical area, and each area can be assessed taxes by different jurisdictions.

Setting up Tax Areas in Business Central

- Search for tax jurisdictions

- Click on +New

- Complete the information in the Tax Area window. In my example I'm going to assign 80470 (zip code) as the tax area code. This is going to help me know what customers or vendors to assign this tax area to base on the zip code.

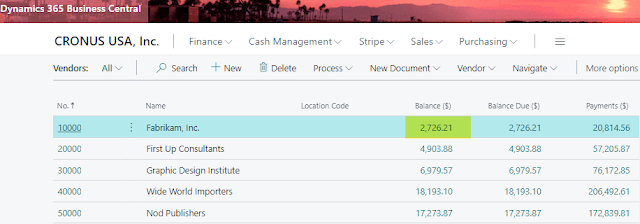

Assigning tax areas to customers and vendors

Within the customer and vendor card there are several fields that pertain to tax in the Invoicing FastTab.

- Tax Liable - toggle yes if you want to collect sales tax (customer) or calculate use tax (vendor).

- Tax Area Code - select the tax area that pertains to the customers address.

- Tax Identification Type - Legal Entity or Natural Person (applies to customer card only)

- Tax Exemption No. - if the customer is tax exempt this is the place where you want to enter their tax exemption number (applies to customer card only).

Item setup

Within the Item Card the Tax Group Code needs to be assigned correctly for sales tax to calculate on a sales transaction.

Sales Order/Invoice sales tax

When you create a sales order or invoice for a customer that is tax liable and an item that is taxable then sales tax should calculate on the transaction. TIP: if for some reason the customer is marked as tax liable on their customer card but the order you're processing is non-taxable then you can update the Tax Liable toggle within the Invoice Details FastTab to make the purchase non-taxable.

When you create a purchase order or invoice for a vendor and you're liable for use tax then you need to check the Use Tax box so that use tax will calculate. Notice I have the Tax Area Code also assigned to the company's tax area since you want to calculate taxes based on where it's being used.

Sales and Use Tax Reporting

- Search for sales taxes collected

- Define your options for the report.

- Print/Preview report.

- Happy tax filing.

Comments