Working with Posting Dates in Microsoft Dynamics 365 Business Central

It's standard practice in accounting to "lock" down closed or future periods to prevent users from posting. Within Dynamics 365 Business Central you have what I call a company setting and a user setting. The company setting affects all users within the company, I refer to this as the "rule" and the user setup allows you to make an exception to the rule.

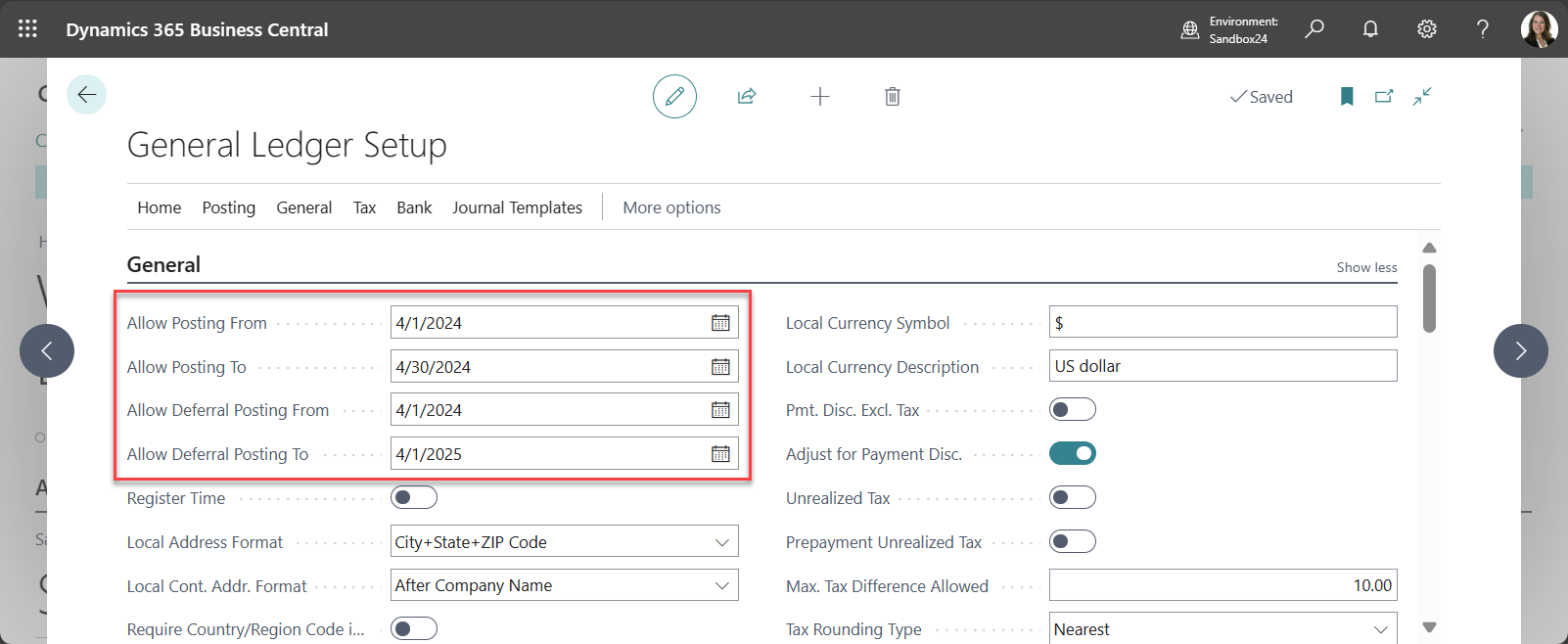

General Ledger Setup

Within the General Ledger Setup window, you have the Allow Posting From and Allow Posting To fields. I often recommend to users that you want to populate these fields with the current account period to restrict users from posting in the wrong period. You also have the option to set dates for the Deferral Postings as well. Keep in mind that the deferral dates may be different than the standard posting dates because you're more than likely posting into the future for the deferrals.

The General Ledger Setup is what I refer to as the "rule."

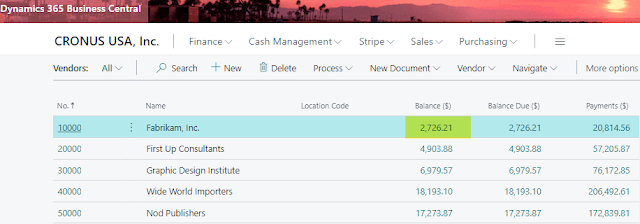

User Setup

If you need an exception to the rule, for example you have a user that should be able to post in a prior period then you can set that up within the User Setup page. You also have the ability to set posing dates for deferrals as well.

In conclusion, managing posting periods effectively in Dynamics 365 Business Central involves a two-tiered approach: company-wide rules set in the General Ledger Setup, and individual user exceptions configured in the User Setup. By establishing posting restrictions through the Allow Posting From and Allow Posting To fields, alongside deferral posting dates, users can maintain accuracy and prevent errors in financial reporting.

Kristen Hosman is a Microsoft MVP in Denver. She works with Dynamics 365 Business Central and related technologies. You can also connect with her through this link: Kristen Hosman | Linktree

Comments